Bankruptcy Options: A Comprehensive Guide to Debt Relief Under Chapter 7 and Chapter 13

Navigating debt relief is crucial for individuals facing financial distress, and understanding bankruptcy options: a comprehensive guide to debt relief under Chapter 7 and Chapter 13 offers a structured path toward a fresh start and financial stability.

Facing overwhelming debt can feel like being lost in a maze, with no clear exit. The financial pressures can be immense, impacting every aspect of life. For many in the US, exploring Bankruptcy Options: A Comprehensive Guide to Debt Relief Under Chapter 7 and Chapter 13 represents a vital first step towards regaining control and establishing a path to financial recovery. This guide aims to demystify complex legal processes, offering clarity and actionable insights.

Understanding the Landscape of Debt Relief

Debt can accumulate rapidly due to various unforeseen circumstances, from medical emergencies and job loss to poor financial planning. When repayments become unmanageable, the prospect of bankruptcy often arises, though it’s frequently misunderstood. It is essential to recognize that bankruptcy laws are designed to offer a fresh start, not to punish individuals for their financial misfortunes.

Before diving into the specifics of Chapter 7 and Chapter 13, it’s crucial to grasp the overarching philosophy behind bankruptcy. It provides a legal framework for individuals and businesses to eliminate or repay debts under the supervision of a federal court. This process offers protection from creditors, halting collection activities, foreclosures, and repossessions. However, it’s not a decision to be taken lightly, as it carries significant long-term implications for credit and financial standing.

The Role of Bankruptcy in the US Legal System

The US bankruptcy system is complex, rooted in federal law, ensuring uniformity across states. It’s categorized into different chapters of the Bankruptcy Code, each designed for specific situations. For individuals, Chapter 7 and Chapter 13 are the most relevant, offering distinct pathways to debt resolution. Both require careful consideration of eligibility, assets, and future financial goals.

- Federal Law: Bankruptcy is governed by federal law, meaning the rules generally apply nationwide, although state laws can influence certain aspects, particularly regarding exemptions.

- Fresh Start Ethos: The core principle is to give debtors a “fresh start” by discharging eligible debts, allowing them to rebuild their financial lives without the continuous burden of overwhelming obligations.

- Protection from Creditors: Filing for bankruptcy triggers an “automatic stay,” which immediately stops most collection actions by creditors, including lawsuits, wage garnishments, and harassing phone calls.

Understanding these foundational elements is paramount before exploring which chapter might be suitable. It’s also vital to consult with a qualified bankruptcy attorney, as the nuances of individual financial situations often require expert legal guidance. This initial consultation can help clarify misconceptions and provide a realistic assessment of available options.

The decision to file for bankruptcy is personal and often emotionally charged. It requires a thorough evaluation of one’s financial health, including income, expenses, assets, and liabilities. This initial assessment helps determine not only whether bankruptcy is appropriate but also which chapter would be most beneficial for the individual’s unique circumstances, ensuring the most favorable outcome possible for their financial future.

Chapter 7 Bankruptcy: The Liquidation Path

Chapter 7 bankruptcy, often referred to as “liquidation bankruptcy,” is typically chosen by individuals with limited income and significant unsecured debts. It is designed to provide a quick financial fresh start by discharging most unsecured debts, such as credit card debt, medical bills, and personal loans. The process is relatively swift compared to other bankruptcy chapters, generally concluding within a few months.

Eligibility for Chapter 7 is determined by a “means test,” which compares the debtor’s income to the median income in their state. If income falls below the median, they generally qualify. If it’s above, further calculations are made to determine if they have sufficient disposable income to repay debts, in which case Chapter 13 might be more appropriate. A key feature of Chapter 7 is the potential for a bankruptcy trustee to sell non-exempt assets to repay creditors. However, most Chapter 7 filings are “no-asset” cases, meaning debtors’ assets are protected by state or federal exemptions, and creditors receive little to no payment.

Key Aspects of Chapter 7 Eligibility and Process

The means test is a critical gatekeeper for Chapter 7. It prevents individuals who can afford to pay their debts from seeking a discharge through liquidation. Beyond income, the debtor must complete credit counseling from an approved agency within 180 days before filing and a debtor education course before debts can be discharged.

- Means Test: Evaluates average monthly income over the past six months against state median income. If above, a second part of the test assesses disposable income.

- Asset Exemptions: Federal and state laws provide exemptions for certain types of property, protecting them from liquidation. Common exemptions include primary residences (up to a certain value), necessary household goods, and retirement accounts.

- Automatic Stay: Upon filing, creditors are immediately barred from collection activities, offering immediate relief from stress and harassment.

The Chapter 7 process begins with filing a petition, schedules, and statements with the bankruptcy court. A trustee is appointed to oversee the case, primarily to identify and potentially liquidate non-exempt assets. Debtors attend a meeting of creditors (often called a 341 meeting), where they answer questions under oath about their financial situation from the trustee and any attending creditors. Most cases proceed smoothly, leading to a discharge of debts.

It’s important to understand that not all debts are dischargeable under Chapter 7. Debts such as most student loans, recent tax obligations, child support, and alimony generally cannot be discharged. Secured debts, like mortgages and car loans, are also treated differently; debtors must decide whether to surrender the collateral, reaffirm the debt, or in some cases, redeem the property by paying its market value. The decision to file Chapter 7 is a serious one, with lasting impacts on credit reports, making careful consideration and legal advice indispensable.

Chapter 13 Bankruptcy: The Reorganization Plan

Chapter 13 bankruptcy, often referred to as “reorganization bankruptcy,” is designed for individuals with regular income who can afford to repay some or all of their debts over time. Unlike Chapter 7, Chapter 13 allows debtors to keep their property while making payments to creditors under a court-approved repayment plan. This plan typically lasts three to five years, during which the debtor makes regular payments to a bankruptcy trustee, who then distributes the funds to creditors.

Chapter 13 is particularly beneficial for debtors who are behind on mortgage payments or car loans, as it provides an opportunity to catch up on these payments and prevent foreclosure or repossession. It also allows debtors to reduce or eliminate unsecured debt, often paying only a fraction of what they originally owed. Eligibility for Chapter 13 is determined by debt limits; specific caps are set for both secured and unsecured debts. If debts exceed these limits, other options, such as Chapter 11, might be considered, though Chapter 11 is typically for businesses or high-net-worth individuals.

The Chapter 13 Repayment Plan and Its Benefits

The core of Chapter 13 is the repayment plan, which must be feasible and proposed in good faith. The plan details how the debtor will repay creditors over three to five years. It must prioritize certain debts, such as child support, alimony, and recent taxes, which must be paid in full. Other debts, like secured loans, may be paid in full or modified, and unsecured debts may receive only a partial payment or no payment at all, depending on the debtor’s disposable income and the amount of their non-exempt assets.

- Keeping Assets: Debtors retain all their property, including homes and cars, as long as they adhere to the repayment plan.

- Stopping Foreclosure/Repossession: The automatic stay, combined with the payment plan, allows debtors to cure arrears on secured debts over time, preventing loss of property.

- Cramdown on Secured Debts: In some cases, Chapter 13 allows debtors to reduce the principal balance of certain secured loans (e.g., car loans) to the fair market value of the collateral, provided certain conditions are met.

- Protection of Co-Signers: Chapter 13 offers a special provision that protects co-signers on consumer debts from creditor action while the debtor is in bankruptcy.

Once the repayment plan is confirmed by the court, the debtor is legally bound to make the agreed-upon payments. Successful completion of the plan leads to a discharge of remaining unsecured debts. Failure to make payments can result in conversion to Chapter 7 (if eligible) or dismissal of the case, potentially leaving the debtor exposed to previous creditor actions. Chapter 13 provides a structured and controlled environment for financial rehabilitation, offering a viable alternative for those who can manage a repayment schedule and wish to protect their assets.

For individuals with a steady income facing temporary financial setbacks, or those with significant assets they wish to protect, Chapter 13 presents a powerful tool for debt management. It requires discipline and commitment over an extended period, but the reward is a clean slate and renewed financial stability without the loss of valuable property.

Qualifying for Bankruptcy: The Means Test and Other Requirements

Understanding the eligibility criteria for both Chapter 7 and Chapter 13 is fundamental before proceeding with a bankruptcy filing. While both chapters offer debt relief, they serve different financial circumstances, and the qualification process reflects these distinctions. The “means test” is the most prominent hurdle for Chapter 7, designed to ensure that those who can afford to repay their debts do not opt for liquidation.

For Chapter 7, your current monthly income is compared to the median income for a household of your size in your state. If your income is below the median, you generally pass the means test. If it’s above, a more complex calculation determines your disposable income, accounting for necessary living expenses and secured debt payments. If you still have significant disposable income, it’s presumed you can afford to pay your debts, making Chapter 7 inappropriate, and pushing you towards Chapter 13 or other alternatives. This ensures fairness and prevents abuse of the bankruptcy system.

Beyond the Means Test: Other Prerequisite Steps

Eligibility extends beyond just income and debt levels. Both Chapter 7 and Chapter 13 have mandatory educational components and specific waiting periods if you’ve filed for bankruptcy previously. These requirements highlight the serious nature of bankruptcy and aim to educate debtors on responsible financial management.

- Credit Counseling: Before filing for either Chapter 7 or Chapter 13, you must complete an approved credit counseling course within 180 days prior to filing. This course evaluates your financial situation and explores alternatives to bankruptcy.

- Debtor Education: After filing, but before debts can be discharged, you must complete a debtor education course. This course focuses on personal financial management moving forward.

- Prior Filings: There are waiting periods between bankruptcy filings. For example, if you received a Chapter 7 discharge, you generally must wait eight years before filing another Chapter 7, or six years before filing a Chapter 13 (with some exceptions).

For Chapter 13, eligibility revolves around having a “regular income,” which enables you to make consistent payments under a repayment plan. This doesn’t necessarily mean a traditional W-2 job; it can include self-employment income, benefits, or pension payments. Additionally, Chapter 13 has debt limits for both secured and unsecured debts. As of recent updates, these limits are periodically adjusted, making it crucial to check the current figures. If your debts exceed these statutory caps, Chapter 13 might not be an option, necessitating an exploration of Chapter 11 bankruptcy or other debt resolution strategies.

Meeting these qualifications requires meticulous preparation, including gathering all financial documents, such as pay stubs, tax returns, bank statements, and creditor notices. Navigating these requirements can be complex, underscoring the importance of legal counsel. An experienced bankruptcy attorney can assess your specific situation, determine your eligibility for various chapters, and guide you through the intricate filing process, ensuring all prerequisite steps are met to maximize your chances of a successful discharge.

The Bankruptcy Process: From Filing to Discharge

The journey through bankruptcy, whether Chapter 7 or Chapter 13, follows a structured legal process. While the specifics vary between chapters, several common stages guide debtors from initial filing to the ultimate goal of debt discharge. Understanding this timeline and the key events involved can help demystify a process that often appears daunting from the outside.

The process generally begins with retaining legal counsel, who will help prepare the vast amount of paperwork required. The petition, schedules of assets and liabilities, income and expense statements, and other financial declarations are filed with the bankruptcy court. This filing immediately triggers the “automatic stay,” providing instant relief from creditor actions. This initial phase is critical, as any inaccuracies or omissions in the paperwork can cause significant delays or even lead to dismissal of the case.

Key Stages and Milestones in a Bankruptcy Case

After the initial filing, your case will proceed through several defined stages, each with specific requirements and roles for the debtor, trustee, and court. These stages are designed to ensure fair treatment for both debtors and creditors, overseeing the resolution of financial obligations.

- Filing the Petition: The official start of the bankruptcy case. All necessary forms and documents are submitted to the court.

- Automatic Stay Takes Effect: Creditors are immediately prohibited from contacting the debtor or taking collection actions.

- Appointment of Trustee: A bankruptcy trustee is assigned to oversee the case, manage assets (in Chapter 7), or administer the repayment plan (in Chapter 13).

- Meeting of Creditors (341 Meeting): The debtor attends a meeting where the trustee and any creditors can ask questions under oath about their financial situation. This is a mandatory and crucial step.

- Confirmation Hearing (Chapter 13 Only): For Chapter 13 cases, the court holds a hearing to confirm if the proposed repayment plan is feasible and complies with bankruptcy law.

- Payments Begin (Chapter 13 Only): Debtors begin making payments to the trustee according to the confirmed plan.

- Debtor Education Course: Completion of this mandatory course before discharge.

- Discharge of Debts: Upon successful completion of the Chapter 7 process or the Chapter 13 repayment plan, eligible debts are legally eliminated.

In Chapter 7, the process usually concludes within four to six months after the 341 meeting, assuming there are no significant assets to sell or disputes. The discharge order is typically issued shortly after the trustee files their final report. For Chapter 13, the process extends over the three-to-five-year repayment plan. The discharge occurs only after all plan payments have been successfully completed, and the debtor has fulfilled all other requirements, such as taking the debtor education course.

Throughout this journey, communication with your attorney and the trustee is vital. Adhering to deadlines, providing accurate information, and attending all scheduled appearances are essential for a smooth and successful outcome. While the process can be stressful, understanding each step helps manage expectations and navigate the complexities effectively towards a new financial beginning.

Life After Bankruptcy: Rebuilding Your Financial Future

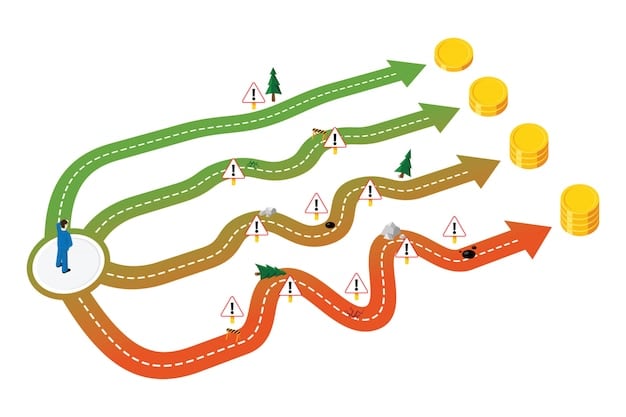

Filing for bankruptcy is not the end of your financial journey; rather, it’s a significant turning point, a fresh start. While bankruptcy remains on your credit report for several years (7 years for Chapter 13, 10 years for Chapter 7), it’s entirely possible to rebuild your credit and achieve financial stability. The period immediately following a discharge is critical for establishing new, healthy financial habits and actively working to improve your credit score.

Many debtors mistakenly believe that their credit will be permanently ruined. While it does take a hit initially, an active and strategic approach to rebuilding credit can lead to significant improvements sooner than expected. The key is consistent, responsible financial behavior. Secured credit cards, small loans, and careful budgeting are common starting points.

Strategies for Credit Recovery and Financial Health

Rebuilding your financial life after bankruptcy requires discipline and a clear plan. It’s an opportunity to implement lessons learned and avoid past financial pitfalls. Focusing on key areas can expedite credit recovery and lay a solid foundation for future stability.

- Review Your Credit Report: Immediately after discharge, obtain copies of your credit reports. Ensure all discharged debts are reported as such and dispute any inaccuracies.

- Secured Credit Cards: These cards require a deposit, which acts as your credit limit. They are an excellent way to demonstrate responsible usage. Make small purchases and pay the balance in full each month.

- Small Installment Loans: Consider a small, secured loan from a credit union or bank. These loans also help build a positive payment history.

- Budgeting and Saving: Implement a strict budget to manage expenses and start building an emergency fund. This prevents future reliance on credit for unexpected costs.

- Avoid New Debts: Resist the temptation to take on new, high-interest debt immediately. Focus on responsible borrowing and manageable payments.

Another crucial step is to educate yourself on personal finance. Understanding budgeting, saving, investing, and the responsible use of credit will be invaluable in maintaining long-term financial health. Bankruptcy can provide the necessary reset, but sustained effort is required to capitalize on this fresh start. Many reputable non-profit organizations offer financial literacy courses and counseling that can provide structured guidance.

Working diligently to improve your credit score will eventually open doors to better interest rates on loans, insurance, and even housing options. While the path to full financial restoration after bankruptcy takes time, it is a testament to resilience and responsible decision-making. Embrace the opportunity to build a stronger, more secure financial future, free from the crushing weight of unmanageable debt.

Alternatives to Bankruptcy: Exploring Other Debt Relief Options

While Chapter 7 and Chapter 13 bankruptcy provide powerful mechanisms for debt relief, they are not the only solutions available. For some individuals, bankruptcy may not be the most appropriate path, or they may not qualify. Exploring alternatives before deciding on bankruptcy can save time, preserve credit to some extent, and offer viable solutions for managing financial distress without court intervention. It’s crucial to understand these options and assess their suitability for your specific situation.

One common alternative is debt consolidation, where multiple debts are combined into a single, new loan, often with a lower interest rate or a more manageable monthly payment. This can simplify repayment and potentially reduce the overall cost of debt. Another option is debt management plans (DMPs) offered by credit counseling agencies. Under a DMP, the agency negotiates with creditors on your behalf to reduce interest rates or waive fees, creating a structured repayment plan that helps you pay off debts over a fixed period, typically three to five years.

Debt Resolution Strategies Outside of Formal Bankruptcy

Beyond consolidation and DMPs, several other strategies can offer relief without resorting to bankruptcy. These range from informal negotiations with creditors to more structured legal arrangements. Each option has its own benefits and drawbacks, and the best choice depends heavily on the individual’s financial specifics and the nature of their debts.

- Debt Consolidation Loans: A single loan replaces multiple debts, simplifying payments and potentially lowering interest rates. Requires a decent credit score to secure favorable terms.

- Debt Management Plans (DMPs): Administered by non-profit credit counseling agencies. They negotiate with creditors for lower interest rates and a consolidated monthly payment.

- Debt Settlement: An agreement with creditors to pay a lump sum that is less than the total amount owed. While it can reduce debt, it significantly harms your credit score and can have tax implications.

- Negotiating with Creditors: Directly contacting creditors to ask for lower interest rates, extended payment plans, or a temporary deferment of payments. Often effective for short-term financial difficulties.

- Consumer Credit Counseling: Provides budgeting advice, financial education, and helps individuals explore all debt relief options.

Debt settlement, for instance, involves negotiating with creditors to pay a portion of the debt owed, rather than the full amount. While seemingly attractive, it can be risky. Creditors are not obligated to agree, and successful settlements typically occur after debts have gone into default, which severely impacts credit scores. Furthermore, the forgiven portion of the debt may be considered taxable income by the IRS.

Each of these alternatives requires careful consideration and, often, professional advice. A qualified financial advisor or credit counselor can help you evaluate your income, expenses, and debts to determine the most viable path. Understanding the potential impact on your credit, overall cost, and long-term financial health for each option is paramount. While bankruptcy offers a comprehensive fresh start, these alternatives provide flexibility and may be preferable for those with temporary financial setbacks or specific types of debt.

Seeking Professional Guidance: When to Consult a Lawyer

Navigating the complexities of debt relief and bankruptcy law is rarely a journey best undertaken alone. The legal framework surrounding bankruptcy is intricate, with numerous rules, exceptions, and potential pitfalls that can significantly impact a debtor’s financial future. This is precisely why seeking professional guidance, particularly from an experienced bankruptcy attorney, is not just advisable but often essential for a successful outcome.

A bankruptcy lawyer brings specialized knowledge of federal and state laws, understanding how they apply to individual circumstances. They can accurately assess your financial situation, determine your eligibility for Chapter 7 or Chapter 13, and advise on the most strategic approach. Without legal counsel, debtors risk making errors in their petition, failing to claim available exemptions, or inadvertently taking actions that could jeopardize their discharge or lead to dismissal of their case.

The Indispensable Role of a Bankruptcy Attorney

The decision to file for bankruptcy carries long-term consequences that extend beyond immediate debt relief. A proficient attorney acts as your advocate, guiding you through every step of the process and safeguarding your interests. Their expertise can be the difference between a smooth resolution and a complicated, drawn-out ordeal.

- Accurate Filing: Ensures all paperwork is correctly prepared, complete, and filed on time, avoiding costly mistakes or delays.

- Maximizing Exemptions: Identifies and applies all available state and federal exemptions, protecting as many of your assets as legally possible.

- Representation in Court: Represents you at the Meeting of Creditors (341 meeting) and any other court hearings, handling interactions with the trustee and creditors.

- Strategic Advice: Helps you understand the long-term implications of each option, including impacts on credit, future borrowing, and potential tax consequences.

- Negotiating with Creditors: While bankruptcy primarily involves court proceedings, an attorney can also advise on or facilitate negotiations with creditors prior to filing, if feasible.

The cost of legal representation might seem like an additional burden when already facing financial distress, but the investment often pays for itself by preventing costly mistakes, protecting assets, and securing the most favorable discharge possible. Many attorneys offer free initial consultations, providing an opportunity to discuss your situation, learn about your options, and get an estimate of fees without commitment.

Beyond legal expertise, a good bankruptcy attorney offers invaluable support during what can be an incredibly stressful period. They can clarify complex legal jargon, manage expectations, and provide peace of mind that your case is being handled competently. Ultimately, consulting a lawyer ensures that you are making informed decisions about your financial future, equipping you with the best chance for a successful fresh start. Do not hesitate to seek this crucial professional guidance when considering your debt relief options.

| Key Point | Brief Description |

|---|---|

| ⚖️ Chapter 7 | Liquidation bankruptcy for individuals with limited income; discharges most unsecured debts, potential asset sale. |

| 📅 Chapter 13 | Reorganization bankruptcy for individuals with regular income; repayment plan over 3-5 years, allows keeping assets. |

| ✅ Eligibility | Determined by means test (Chapter 7) or regular income/debt limits (Chapter 13), and mandatory credit counseling. |

| 🧑⚖️ Legal Counsel | Essential for navigating complexities, ensuring accurate filing, maximizing exemptions, and effective representation. |

Frequently Asked Questions About Bankruptcy

Chapter 7 involves liquidation of non-exempt assets to discharge debts, typically suited for lower-income individuals. Chapter 13 is a reorganization that allows debtors to keep assets and repay debts through a court-approved plan over three to five years, ideal for those with consistent income.

Not necessarily. Most Chapter 7 cases are “no-asset” cases, meaning debtors’ property is protected by federal or state exemption laws. Common exemptions include primary residences up to a certain value, vehicles, and household goods, allowing many to keep their essential belongings.

A Chapter 7 bankruptcy remains on your credit report for 10 years from the filing date, while a Chapter 13 bankruptcy stays for 7 years from the filing date. Despite this, it is possible to start rebuilding your credit sooner with responsible financial habits.

No, not all debts are dischargeable. Generally, most student loans, recent tax obligations, child support, alimony, and debts incurred through fraud are non-dischargeable in both Chapter 7 and Chapter 13. Secured debts are also treated differently, often requiring reaffirmation or repayment.

Yes, federal law requires individuals to complete an approved credit counseling course from an accredited agency within 180 days before filing for either Chapter 7 or Chapter 13 bankruptcy. A debtor education course is also required before discharge.

Conclusion

Navigating the complex world of debt relief requires a clear understanding of all available options. This comprehensive guide has explored Bankruptcy Options: A Comprehensive Guide to Debt Relief Under Chapter 7 and Chapter 13, highlighting their distinct characteristics, eligibility requirements, and the profound impact they can have on a debtor’s financial future. Whether through the swift discharge of Chapter 7 or the structured reorganization of Chapter 13, both provide a legal pathway to a fresh start. Ultimately, the decision to pursue bankruptcy or one of its alternatives should be made with careful consideration and, ideally, with the expert guidance of a qualified bankruptcy attorney, ensuring the best possible outcome for your unique financial situation and paving the way for a more stable and secure tomorrow.